December 3, 2025

Are You in the Right Place?

Four years ago I moved to Dallas based on a spreadsheet. People move for all kinds of reasons. Jobs take them from one city to another, romantic partners have a way of pulling people around, college does it, and family makes the choice sometimes. You may have other reasons for living in the city you live in right now. These all strike me as fine and valid reasons to live in a particular city, but I approached moving from NY to TX differently.

This may sound like a paid advertisement for Dallas, so I’ll address it up front. It’s not! Dallas won’t be the answer for everyone. It ended up being the right place for me after I deliberately investigated a question I’m not sure many people ask themselves:

Where should I actually be over the next few decades?

The question compelled me to build a matrix to weigh my priorities, and I wanted to start with my kids. My list of variables included the best schools, economic outlook for the next few decades, housing affordability, access to an international airport, traffic congestion, weather, business-friendly policies, the talent pool for building businesses, and a family-friendly community. No place is perfect, but the top three cities for my family were Nashville, Austin, and Dalas. I landed on Dallas.

Life offers you moments where you can architect your future. We often let these moments pass us by as we stay on cruise control. Sometimes there are natural points that call for decisions that will alter the course of your life: leveling up through high school and college, or going from college to your first job, or you get relocated. But those are not the only times you can move.

With young kids, I knew every passing month would make it more complicated. Their lives would start to get more established, they would make more friends, and our roots would grow deeper. So I moved while I could.

Here’s a conversation I have often:

Them: What brought you to Dallas? A Job?

Me: No. A spreadsheet.

Them: *blink *blink *blink. No family?

Me: Nope.

Them: Not school?

Me: Nope.

So here’s what I took into account.

Numbers to consider

I started with schools. Dallas ISD has three of the top 10 high schools in Texas, and one in the top 10 nationally. Having an infrastructure of top schools mattered to me because I believe a good education matters, which numbers associated with earnings support. a report from Brown University shows students who attend a high school ranked in the top 80% complete a four-year degree at a higher rate than kids who attend a high school in the 20th percentile, which can translate into a 13% high salary at age 30.

Cost of living was the second variable. For the same standard of living, NY requires 130% more money. LA is 50%-60% higher. San Francisco? 70%-80% more. Here’s a dollar-to-dollar comparison for Dallas versus other major cities. To match the purchasing power of $100 in Dallas, you’d need:

- $230 in New York

- $150-160 in Los Angeles

- $170-180 in San Francisco

- $110-120 in Chicago

Airports mattered to me too. I wanted a world-class airport in a centrally located position so I could conveniently get to the places I go most. Dallas has shorter flight times to either coast than if I had to fly all the way across the country on one flight. It also has more nonstop international and domestic destinations than any other airport in North America, which makes vacations easier. My friends and family can also get easy flights to me.

Another headache in daily life is traffic. Relative to my time capacity, I have every single thing I need within 15 minutes of my house. Dallas ranks in the top 10 cities for commutes among major US cities in a comprehensive ranking that includes time, average speed, cost, and other metric. Do I have access to the same level of museums or theater as I did in New York? No, definitely not, but Dallas has some great options. Plus, I took advantage of that NYC had to offer in my 20s and 30s and feel content.

Then there’s growth, and projections show the Dallas-Fort Worth metro should hit almost 11 million people by 2040, (a 53.5% increase) because of migration patterns and birth rates. The metro added over 90,000 people in 2024 alone, and when a place is growing that fast, opportunity follows. Dallas-Fort Worth is projected to become the third-largest metro area in the United States sometime in the 2030s, surpassing Chicago. And talent: Dallas has 21 Fortune 500 companies headquartered in the area, including AT&T, ExxonMobil, and Southwest Airlines. The unemployment rate hovers around 4%, and the DFW area added 139,700 jobs in 2023, which means you can build a team without relocating people from across the country.

If you’re building a business in Dallas, the talent economics work in your favor. Wages are slightly lower here, but the cost of living is lower too. We get the same level of talent for slightly less money, and the employee gets a higher standard of living. That’s good for everyone.

Business-Friendly Policy

Texas has ranked #1 for Best State for Business for 20 consecutive years, according to Chief Executive magazine’s annual CEO survey. The state has also welcomed over 314 corporate headquarters relocations since 2015, and currently supports 3.3 million small businesses.

In Texas you can build a company in an environment where the government actively removes friction rather than adding it. Any competitors operating out of high-tax, high-regulation states are running uphill. Again, it’s not perfect, but it’s incrementally better.

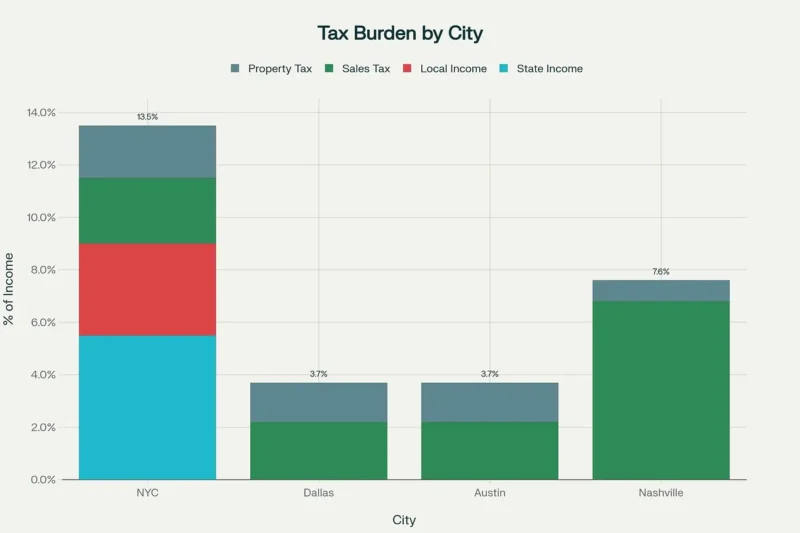

Texas has no personal income tax and no corporate income tax, which is constitutionally protected. Instead of income taxes, the state funds itself through sales tax and property tax. Texas residents face a combined state and local tax burden of just 3.7% of income, less than one-third of New York’s 13.5%. This is despite having higher property taxes because eliminating state income tax saves residents far more than they pay in additional sales and property taxes.

The entire tax structure is fundamentally different, so when you add up all the taxes you pay (income, sales, property, and local fees), Texas residents pay far less of their income to government than people in high-tax states.

These numbers mean something to personal finances, but they compound when I think about building a company with a lower cost-base. I’ve been able to recruit talent out of NY and explain to these candidates how they may have a lower headline salary, but the combination of lower tax burden and cost-of-living means they will take home more money. They get a raise in purchasing power.

Companies with revenue below $2.47 million pay zero franchise tax, a threshold thousands of small businesses will not exceed. To further cut red tape, the state launched the Governor’s Small Business Freedom Council. As I look back at NY from 1,550 miles away, I see Dallas making more business-friendly decisions and NY going in the other direction.

Booming Corporate Environment

Major financial firms keep announcing expansions into Dallas. Wells Fargo recently opened a $570 million campus in Las Colinas in October 2025, bringing together 4,500 employees in an 850,000-square-foot facility. Goldman Sachs is building an 800,000-square-foot campus in the North End development for more than 5,000 employees when it opens in 2028.

Then there’s the Texas Stock Exchange. The SEC approved TXSE in September 2025, making it the first new, fully integrated U.S. stock exchange in decades. Backed by $161 million from investors including BlackRock, Citadel Securities, and Charles Schwab, the exchange plans to begin trading in 2026. Dallas is already the second-largest financial center by employment in the United States, behind only New York City.

These moves signal the infrastructure for a major financial hub is being built in real time. The expansion of the financial sector is impressive enough, but other major companies also see the value here.

CRBE Group, the world’s largest commercial real estate services and investment company, relocated from LA to Dallas in 2020 and brought over 70k jobs with them. McKesson, a Fortune 500 healthcare company, moved from SF in 2019. Yum! Brands (think KFC, Pizza Hut, and Taco Bell) came to Dallas this year.

Even Dude Perfect, a content creation company, wants to build here. They have a $3-5M HQ planned that will span over 80,000 sqft. Once established, they plan to expand by creating a $100M+ expansion and theme-park where guests can try out trick shots of their own.

Side note: these trick shots blow me away.

But having a growing economy with a robust talent pool isn’t the only economic factor to consider. Dallas is interwoven with other critically important economies, and I think those connections give it high upside and mitigate risk.

Share Value Beyond the Spreadsheet

The North American Corridor

Texas sits at the heart of what’s called the North American corridor, the trade route running from Mexico through the United States to Canada. This corridor has about 500 million people and accounts for nearly 30% of global GDP, about $31 trillion.

I didn’t know this until recently, but Texas is Canada’s second-largest trading partner, with $76.1 billion in trade in 2024. If Texas were its own country, the United States would be its largest trading partner, but Canada would be second. That’s not a small detail.

Moreover, Mexico is Texas’ largest trading partner at $281 billion, and the Texas-Mexico border handles 68% of all trade between the United States and Mexico. I want to be in the middle of massive economic flow like that, and Dallas puts me there.

Turning a constraint into a variable

Many people spend their entire lives upgrading locally. They buy a bigger house, in a nicer neighborhood, in a better school district within their city. But they never ask if they’re in the right city to begin with.

Location multiplies every other decision you make. The schools your kids attend, the people you meet, the industries that are hiring, the cost of your mortgage relative to your income, and the infrastructure that gets built around you over the next 20 years all flow from where you choose to be.

Most people are where they are because that’s where they landed. And look, there’s nothing wrong with staying somewhere for family, or roots, or just because you like it. In fact, there can be magic in having your kids grow up and be friends with your friends’ kids. I have friends who never moved from their hometown who have great lives. But you should at least know what you’re optimizing for.

When you start to see location as a variable you can adjust, not a constraint you have to accept, it gives you agency in the downstream outputs of your location. ****

You can spend decades optimizing everything inside a system that’s working against you, or you can change the system. Once I saw that hidden mechanism, I couldn’t ignore it. I didn’t want to focus on incremental improvements. I wanted to take advantage of the structural benefits of living in the right place. Run the numbers you care about, because they matter more than you might think.

I approached the decision objectively, ran the numbers, considered the implications for my family, and moved. We made some sacrifices. We need to travel to see our families, for example. That’s real. But I recognized location as a variable I could change, not something forced upon me. Four years in, it’s exceeded my expectations. A spreadsheet can’t capture everything, but Dallas has even over-delivered in those extraneous areas as well. Restaurants, for example. I like them so much more than I thought I would. The grocery stores blow my mom away every time she visits. We don’t go to as many shows now as we did in NY, but we’re happy with the options when we make it out. The tailwinds I saw in terms of Dallas’ economic expansion are blowing the sails harder than I thought they would, too.

If you get annoyed by how much you pay in taxes, how long you sit in traffic, what kind of talent you can hire (and afford to pay a good wage), crumby weather, or anything else, I encourage you to consider you have the power to change those things. You’re not as stuck as you might feel. Moving comes with friction, but it might be worth it when you consider the compounding effects of a new location over twenty years. Break out a spreadsheet to see what your next move may hold.

You might also enjoy: saving 1,000 jobs.

Oh, and don’t forget, if you don’t like where you landed. You can move.

Shaun Gordon scaled a company to 1,000 employees, built and sold two businesses, and now acquires companies through Astria Elevate in Dallas. Whether you’re building, buying, or thinking about what’s next — he’s always happy to talk.