October 13, 2025

Through the rivers

A six-foot tall man takes a few steps into the woods on a long hike. Before long, he comes to a stream and wastes no time stepping off the bank and into the fresh water. It’s cold on his ankles at first, but he acclimates quickly. The water passes his ankles. Then he’s up to his thigh, but he knows the river’s only four feet deep on average. No problem. Occasionally the water rises, but then he finds a sandbar and the water goes back to his calves — more about my journey.

But about a quarter of the way across, the current picks up and the water rises past his chest. He wades forward, thinking the average will protect him. But it doesn’t shallow out. It whisks him away and he drowns before he gets to the other side, a victim of the average.

Shout out to Howard Marks for the inspiring metaphor. Here’s the connection to cash.

The Profit Fallacy

Photo by Bovia & Co. Photography on Unsplash

When you build your first business, nobody tells you how to look at cash. You hear the proverbial words of encouragement to “focus on cash,” or that “cash is king.” The industry might seem safe, predictable, and simple. The businesses’ monthly or annual figures might also lead you to believe it’s not complicated, but actual cash doesn’t sit still the way the figures do on those reports. Managing cash flow can make “simple” businesses complicated. For example, large cash drawdowns may be imperceptible in the weekly or monthly financials.

Profit doesn’t automatically guarantee success for businesses, but it’s a dangerous fallacy business owners often believe. For instance, you might have a great large customer but what happens if your customer takes a year to pay you? You might have an expected profit but run out of liquidity (and have to shut your doors) before you collect. A 2024 survey showed 42% of small business owners have too much confidence in their money management skills. Nearly all business owners (95% according to this study), make major decisions based on the bank balance rather than a forward view. So they don’t account for timing as much as they could, and timing is critically important. Often companies collapse not because demand is weak or products are flawed, but because the inflows of cash do not align with the outflows.

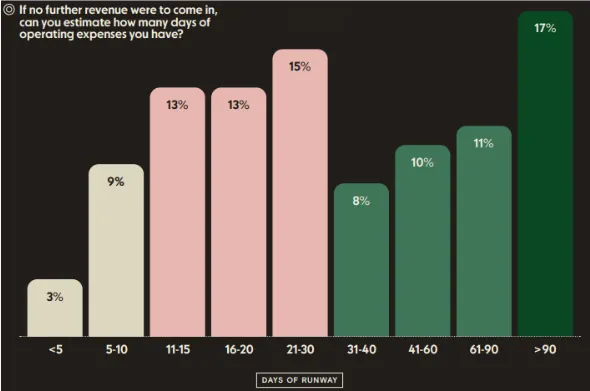

Customer receipts rarely line up neatly with outflows. Payroll, rent, insurance, terms with vendors, tax payments, debt service, and one-off commitments bunch up in specific weeks. In 2024’s Small Business Credit Survey, the Federal Reserve reported more than half of employer firms struggled with paying operating expenses and 51% cited uneven cash flows as a challenge in the prior year. It makes sense when you consider 53% of small businesses do not have more than a month’s worth of runway.

Forecasting Cash

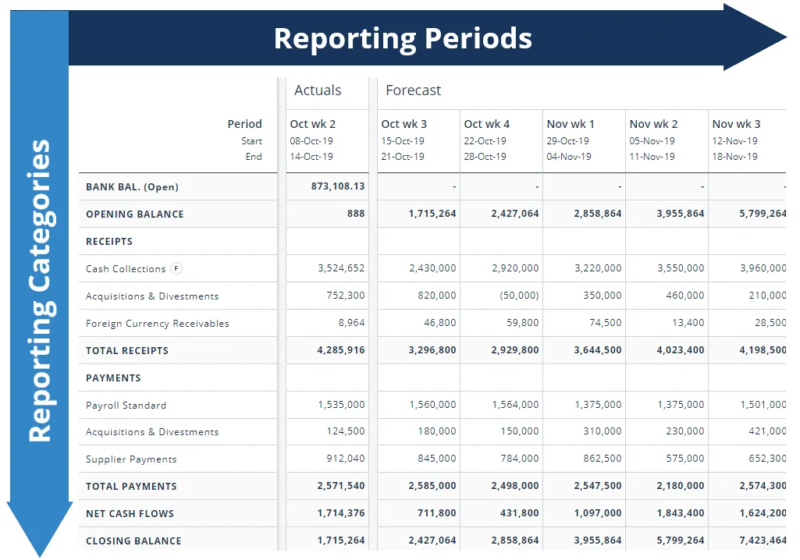

So how do you better account for timing? Stop trusting averages, diligently forecast your inflows and outflows, and update the plan at least weekly. The most practical tool is the thirteen-week rolling cash flow forecast. A Deloitte survey found that companies using rolling forecasts were 36% more likely to respond effectively to rapid shifts in demand.

At its core, a thirteen-week forecast lays out every material inflow and outflow by week for the next quarter. Customer payments, payroll runs, supplier terms, tax dates, debt service, and one-offs all sit in the forecast where they actually hit cash. Each week, replace estimates with actuals, drop the closed week, and add another one so you always see thirteen weeks ahead.

Two things happen when operators adopt it. First, they end up with fewer fire drills. They can see when their bank accounts will have low points before they arrive so they can adjust accordingly. Second, they have better tools to sharpen decision-making. With a forward view, it becomes practical to accelerate collections, negotiate terms, defer noncritical purchases, or line up short-term financing before it becomes urgent.

The discipline of running “what if” scenarios becomes possible. What if customer payments are a few weeks late? What if sales spike and you need to buy more inventory up front? What if taxes are higher than expected? Owners often avoid this exercise because it feels tedious or imperfect. It requires accurate data from accounting, sales, and operations, and it will never be flawless. But the point is not perfection. The point is getting visibility on cash to gain the ability to proactively address issues instead of having to react to them.

Special risks in family businesses

The challenge is even greater for family-owned and founder-led companies. In many cases, personal and business finances blur together. Owners draw money for household needs, reinvest in the company, or pay family members in ways that distort the real picture of cash.

PwC’s 2023 Family Business Survey found that only 34% of family businesses have robust governance structures in place and just 19% have sophisticated risk-management practices. At the same time, 70% admit to mixing personal and business finances at some point, which makes accurate forecasting harder.

Seasonal businesses face another complication. On an annual basis, everything may look fine, but nearly all seasonal business owners experience dramatic revenue swings. Cash inflows can drop by 50% or more during slow months, and cash can become dangerously tight because the yearly average hides the valleys. The fixed costs, like rent and salaries, persist in the lean months and pinch cash flow.

Finally, family businesses often carry a legacy mindset. They prioritize stability and avoid risk, which creates a tendency to delay decisions until a crisis forces them. The PwC report cited above also showed only 19% of family-owned businesses have a formal risk management plan in place. By then, the solutions get more expensive than getting ahead of it would have.

Share Value Beyond the Spreadsheet

It’s about operational control

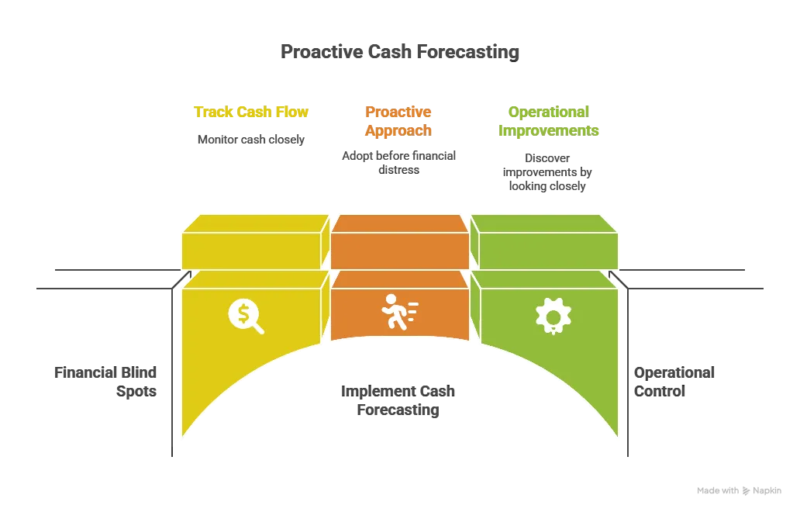

Owners often overlook financial reporting and forecasting because it is not the most enjoyable part of running a business. Selling, building, and leading people often energize them, while updating a cash forecast feels tedious. It can be tedious, but it gets more efficient over time. It also gets more accurate, which means it’s more valuable. Ignoring this critical process leaves blind spots that can even sink healthy companies.

I like this reframing: getting visibility on the cash provides operational control. It’s not just a financial exercise. It tells you how fast you can grow, what risks you can take, and when you cannot afford surprises. The companies that survive the long run are the ones that treat this discipline as non-negotiable, regardless of whether it is fun or easy.

In practice, most companies in the lower middle market don’t use a cash forecast at all. The ones that do usually adopt the practice in financial distress. After going through a cash squeeze a few times before, I appreciate a proactive approach and have been amazed by how many operational improvements we discover because we’re looking at cash so closely.

Do it before you’re underwater

Checking your bank account every day (or every hour) doesn’t count as keeping an eye on cash. Knowing the amount of cash you have is a data point, but you have to look upstream so you can determine why the money ebbs and flows. Reviewing monthly financials is not enough. Proactive, cash-conscious leaders foresee (well in advance) periods when cash will get tight. They create time for themselves to navigate around choppy water in advance.

You might also enjoy: 11 regrets when selling your business.

If he knew, I bet the six-foot tall man would’ve put on a life-jacket before the river dropped to twelve feet and he succumbed to a current too strong to fight. Do not be the guy that drowns. Map the river. Build your forecast. Understand the cash drawdowns before you’re underwater.

Shaun Gordon scaled a company to 1,000 employees, built and sold two businesses, and now acquires companies through Astria Elevate in Dallas. Whether you’re building, buying, or thinking about what’s next — he’s always happy to talk.